The Central Bank of the Republic of Türkiye (CBRT) has completed the phase 1 of its digital Turkish lira. It is now planning to move on to advanced phases to carry out “more widespread pilot tests.”

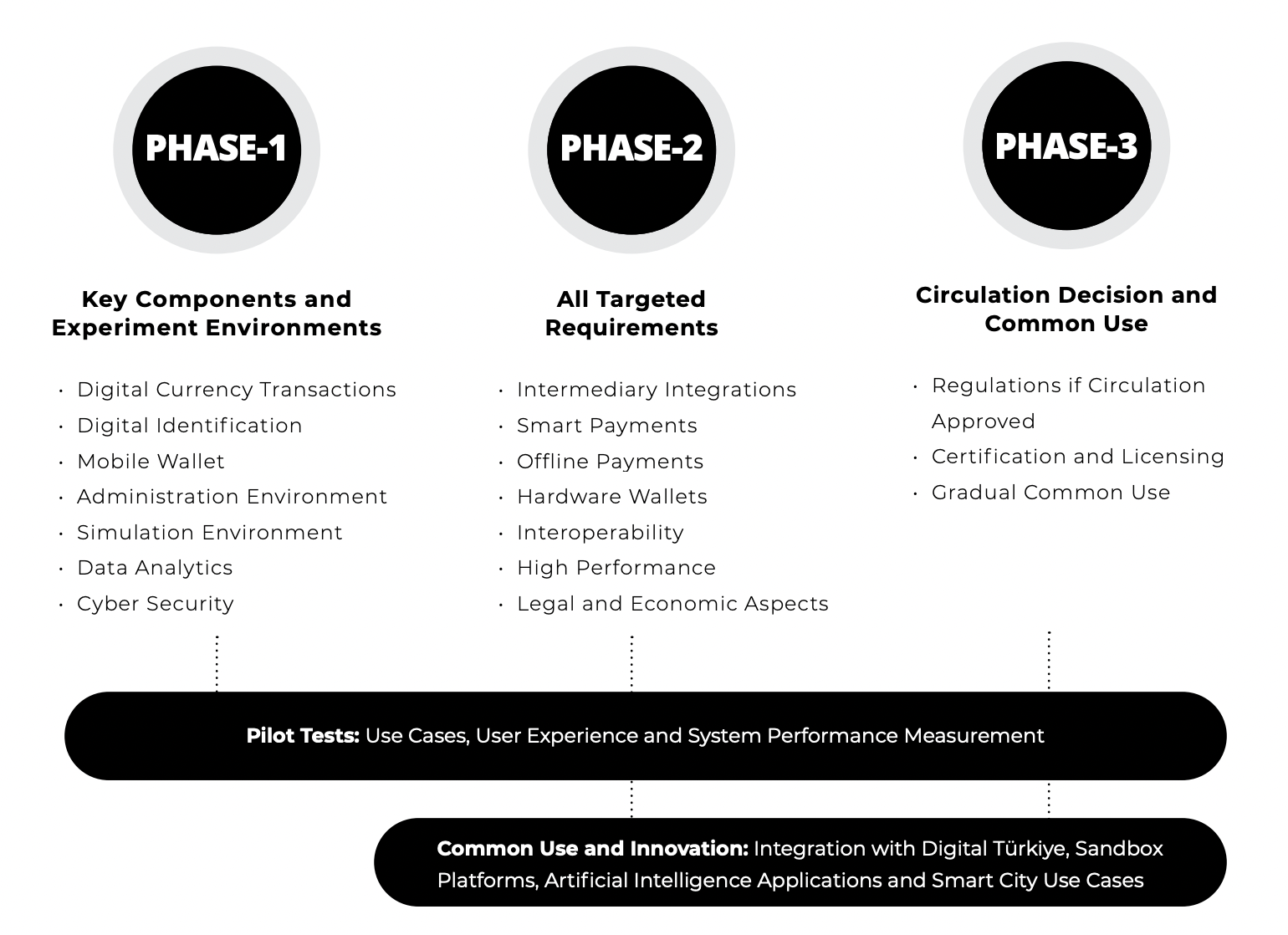

Per a recent evaluation report, the bank is preparing for all aspects of the circulation of the CBDC. The phase 1 of the central bank digital currency (CBDC) involved preliminary tests of strategic technologies.

“In the pilot test studies during this phase, the aim was to conduct tests at specific locations and to measure the user experience and system performance.”

The evaluation report is a compilation of findings and assessments such as digital currency transactions, wallet application and digital identification.

“What is important for the digital Turkish lira is to prepare a system that fully meets the requirements and principles of digital currency rather than the technology itself” it read.

The report highlighted CBRT’s digital lira efforts beginning in 2021, exploring the feasibility and implementation of a CBDC. On December 2022, the central bank successfully executed the first payment transaction on the digital Turkish lira network.

In September 2023, a Chainalysis research showed that Turkey’s crypto adoption rate has skyrocketed from 16% to 40%.

The central bank noted that it would continue with the R&D activities through following phases. Furthermore, the upcoming phases will explore conversions between forms of CBDC, smart payments, offline payments, legal and economic dimensions.

“In the second phase, the Digital Turkish Lira Collaboration Platform will be expanded with the involvement of new participants, and pilot tests of different scenarios will be conducted.”

Source: Digital Turkish Lira – First Phase Evaluation Report 2023

Source: Digital Turkish Lira – First Phase Evaluation Report 2023However, the CBRT is yet to finalize the architecture and design of the digital lira. It is looking for possible design options and whether these options meet the economic, legal and fiscal requirements for CBDC.

“Following the assessments, a decision will be made on its circulation,” it added.